In reply to SV reX :

I think what changed is that in the last year or two credit processing fees have increased rapidly, in large part because rate increases were postponed during the pandemic and have recently taken effect all at once. This article is advertising an alternative in the end, but has a good overview:

https://www.paystand.com/blog/the-state-of-credit-card-fees-2023

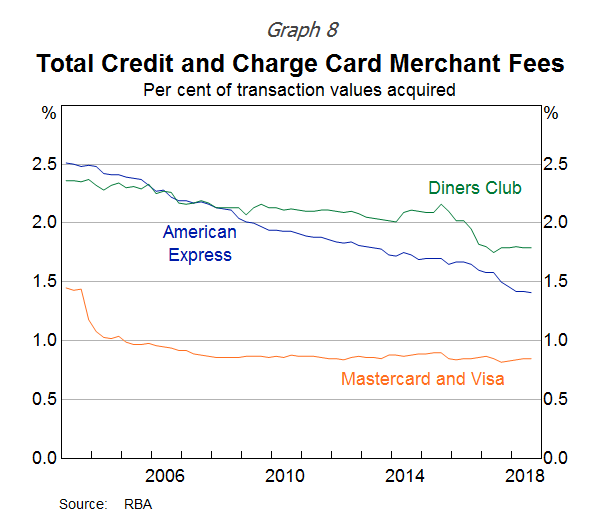

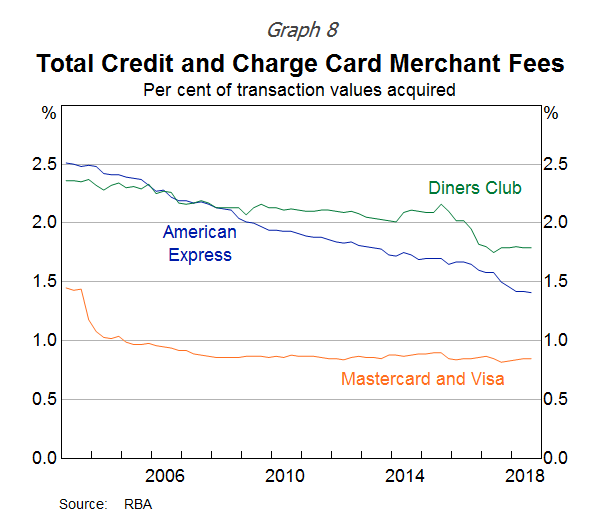

Big businesses that have more leverage with the credit card companies and fatter profit margins to potentially absorb transaction costs can mitigate or withstand that a lot more easily than small businesses. I found this graph showing an effective rate for the big 2 credit card companies of under 1% from the early-'00s until a couple of years before the pandemic, and now businesses are seeing 3-4% effective rates:

Edit: That data is from Australia so it may be different elsewhere but it's all I could find. Things actually tend to be more expensive in Australia though. Source: https://www.bis.org/review/r181126a.htm

RX Reven' said:

I have a coin operated business as a side hustle and US Bank recently bought out the bank I happily did business with for years.

A few months ago they started charging me $30 per month to take my coins...%$#@&

At least they're better than BoA who started refusing to take my coins in tamper resistant, sealed bags and then began short counted my $500 bags by $20 to $40.

I contacted the Feds about BoA's theft but I was too small of fish for them to care.

You could probably do them in smaller batches if you can find non-bank businesses that have change machines, but I think they're getting pretty rare these days. I remember seeing one in a supermarket a couple years ago.

SV reX said:

I am an enormous supporter of small business.

The fact remains... for over 50 years businesses survived fine without adding processing fees to transactions , and in the last few years they suddenly feel the need to do it. Nothing has changed that justifies it (and transaction fees used to be higher than they are now).

Just like the there is a lot of stuff that doesn't justify the huge increase in costs in a lot of things. Companies are saying "inflation" while also posting record profits.

But I suspect that will take the thread down the patio path.

In reply to GameboyRMH :

Thank you for your guidance.

The volume makes that impractical and they charge several percent unless you take the payment in the form of a gift card.

Fun fact..my machines are quarters only but I get some lower denominations throughout the year and the amount is nearly a perfect match for what I spend at Home Depot for annual overhaul supplies.

There's an elegance to it...once a year I dump the dimes and stuff into a Coin Star, get a certificate, and buy all the paint, grease, etc. I need.

SV reX

MegaDork

1/26/24 6:28 p.m.

In reply to GameboyRMH :

Credit card transaction fees in 1981 were from 3-5%. I remember 6%. No one added fees for their use.

Business transaction fees in 1981

They are much less now.

SV reX said:

I am an enormous supporter of small business.

The fact remains... for over 50 years businesses survived fine without adding processing fees to transactions , and in the last few years they suddenly feel the need to do it. Nothing has changed that justifies it (and transaction fees used to be higher than they are now).

I would think the difference between then and now is the % of card vs cash transactions, and the average transaction cost. I'll use 100% made up numbers, but assume the average convenience store purchase 20 yeas ag was $20 in gas and $5 in stuff, 300 transactions per day. That's $7500 a day, figure 40% was on cards. $3000 x 5% fee is $150 a day. $4650 a month. Now it's $40 in gas, $8 in stuff. $14,400 a day and I'd think 90% on cards, if not more. $12,960 at 3.5% is $453 per day, or $14k per month.

SV reX said:

In reply to GameboyRMH :

Credit card transaction fees in 1981 were from 3-5%. I remember 6%.

Business transaction fees in 1981

They are much less now.

They're 2-3.5% now on average, so less but can still add up quick.

SV reX

MegaDork

1/26/24 6:32 p.m.

In reply to Steve_Jones :

Right, but the chargers were charged to EVERYONE (including cash customers) in the form of higher prices.

Those higher prices still remain, AND vendors are also adding transaction fees.

That's overhead.

SV reX

MegaDork

1/26/24 6:33 p.m.

In reply to Steve_Jones :

They are 2-3 1/2% for small volume businesses. The average the consumers is 1 1/2%.

Steve_Jones said:

I would think the difference between then and now is the % of card vs cash transactions, and the average transaction cost. I'll use 100% made up numbers, but assume the average convenience store purchase 20 yeas ag was $20 in gas and $5 in stuff, 300 transactions per day. That's $7500 a day, figure 40% was on cards. $3000 x 5% fee is $150 a day. $4650 a month. Now it's $40 in gas, $8 in stuff. $14,400 a day and I'd think 90% on cards, if not more. $12,960 at 3.5% is $453 per day, or $14k per month.

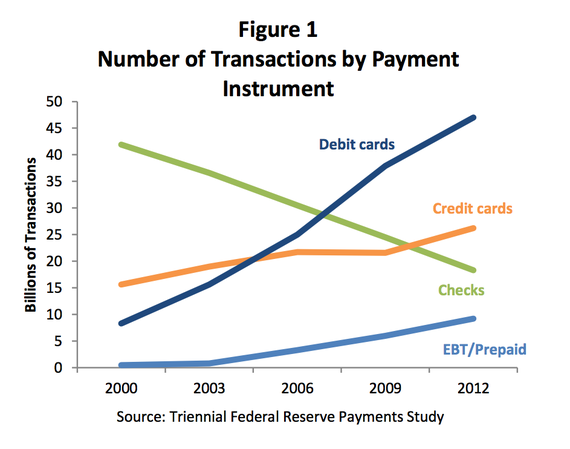

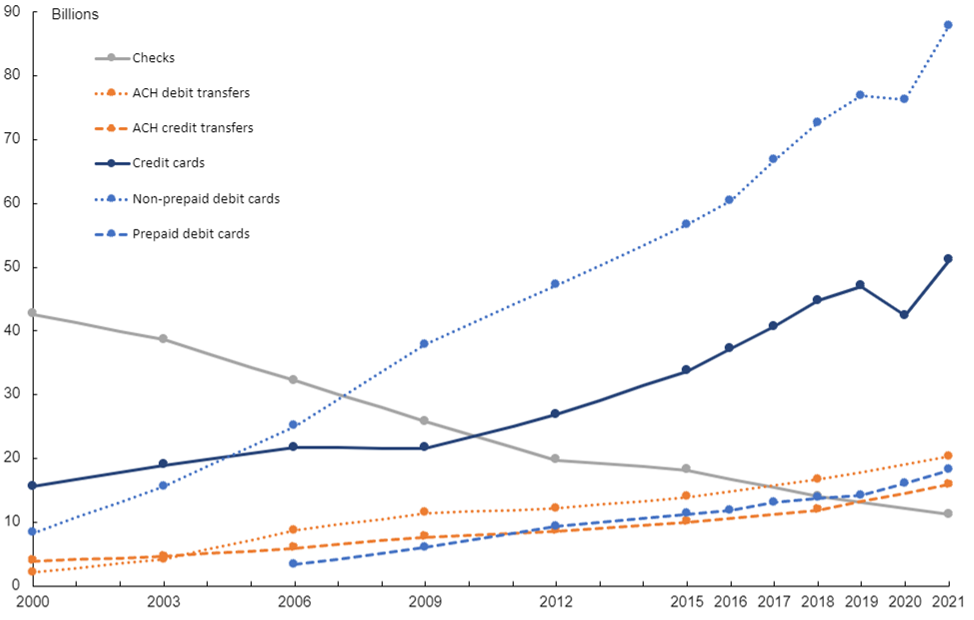

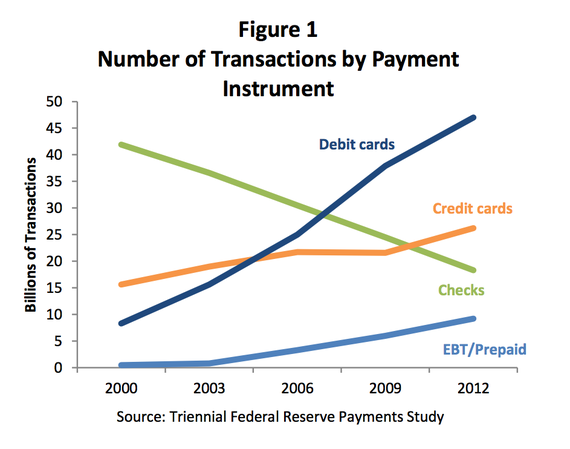

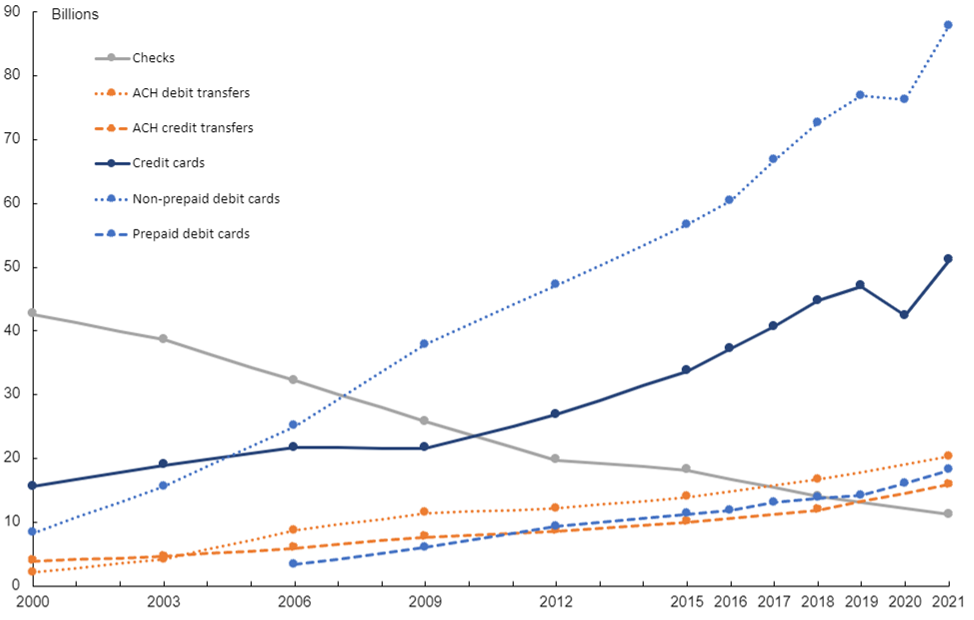

When I was trying to find any graph of processing fees over time, I instead ran across plenty of graphs like this:

And this (from US Federal Reserve data):

So both the proportion of payments and the absolute amounts have been growing pretty steadily.

SV reX

MegaDork

1/26/24 6:59 p.m.

In reply to GameboyRMH :

That's all fine. I get it. Stuff is more expensive. Doesn't really relate to this thread.

Vendors have started ADDING transaction fees to consumers that never existed before. They were always known as overhead.

And some of them are illegal.

SV reX said:

In reply to GameboyRMH :

Credit card transaction fees in 1981 were from 3-5%. I remember 6%. No one added fees for their use.

Business transaction fees in 1981

They are much less now.

True, but I don't think the historical state of affairs was a good one. The current arrangement where vendors in most jurisdictions can't pass on transaction fees and the credit card companies can set those fees to whatever they like is a recipe for allowing the major credit card companies to become extortionate middlemen at will. I think the only thing that's caused them to refrain from doing this throughout a majority of their history has been a fear of regulation changing this arrangement that has effectively made them universal retail toll-collectors, but I think it's about time for that to happen.

If vendors could pass on transaction fees then at least consumers and vendors would have a way to effectively opt-out of the situation by paying via some other method, and thus allow market forces to apply some downward pressure on credit card transaction fees. Right now the only way the market can apply any downward price pressure is by vendors opting out of accepting credit cards entirely, which seems to be happening in Canada now.

A non-market solution would be to price-control the transaction fees, which doesn't seem unreasonable if vendors are forced to absorb them.

SV reX

MegaDork

1/26/24 7:25 p.m.

In reply to GameboyRMH :

I don't think that is true.

As I understand it, vendors are free to pass on transaction fees. They just have to pass on actual fees, not excess. And debit is different than credit (which many vendors ignore)

I just think it is a terrible idea. (From a business perspective)

In reply to SV reX :

Doing some more research, I think we're talking about two different components of what businesses have to pay to use credit cards: processing fees and interchange fees. Processing fees are the smaller fraction and can be legally passed on to consumers in most jurisdictions. Interchange fees are the majority of the cost and in most jurisdictions legally cannot be passed on to consumers. Very few jurisdictions allow vendors to pass on a cost in excess of the fee (which I agree would not be a good thing):

https://www.clearlypayments.com/blog/interchange-fees-by-country/

SV reX

MegaDork

1/26/24 7:57 p.m.

In reply to GameboyRMH :

So, you're saying businesses should not be passing on fees to consumers?

Ok. We agree.

SV reX said:

In reply to GameboyRMH :

I don't think that is true.

As I understand it, vendors are free to pass on transaction fees. They just have to pass on actual fees, not excess. And debit is different than credit (which many vendors ignore)

I just think it is a terrible idea. (From a business perspective)

You're misinformed here at several points. I'm on mobile so it works be difficult to go into great detail, but effectively:

Jurisdictions set limits for what is allowed. In my state businesses are allowed to pass on up to 4% of processing fees, period (regardless of their cost).

Debit and credit card fees are the same for my processing. I get charged 2.9% regardless.

You're talking about "bad business" this and "it should be included" that, but I still don't understand why you don't want the option of paying less for a good or service if you have cash. Seriously, why would you not want to have the option of getting a 3% discount?

You also confuse or conflate how processing fees work for big vs small businesses and how it affects margins.

Processing fees to merchants have risen over recent years. In Europe they're capped to something like 1/100 of what they are in the US and somehow banks make it work and still make plenty of coin. What you're seeing now is a form of protest and market forces by merchants. All they've really done is taken away the cloak of invisibility on what transactions cost and are giving you the option of paying for the convenience (and of paying for your own points/rewards) of using a card.

Don't like it? Carry cash and save money. Do you really feel that you shouldn't be offered a discount for paying cash, or that merchants shouldn't encourage competition and should shoulder the burden of your payment for you?

Say you go to a gas station. The price has always been $4 a gallon but they pump the gas for you. Suddenly there's a new gas station across the street and the gas is priced at $3.75 if you pump the gas yourself or $4 if they pump it for you, would you a) refuse to pump it yourself and b) complain that they're giving you the option of taking away a cost?

Here's why I don't care for discounts based on payment method:

1. It is annoying. Ever pull into a gas station and then realize the price they had on their sign was the cash only price, and worse, their credit card price was more than the gas station across the street who isn't playing price games?

2. It fully overlooks the overhead of a business using cash/other forms of payment. How much time do employees spend making change, counting and balancing drawers, monitoring and disciplining employees who steal, and paying for the bank truck every day? All that costs money. I would bet that Walmart spends more to transact in cash/checks than they do to transact in cards.

3. I get the feeling some small businesses are using the "cash discount" to cheat their taxes, which is really more like a 20-30% advantage to them, but of course they don't pass that "savings" along to me. Cash makes a world where honest businesses and people are at a disadvantage to dishonest people.

I do not want to save 3% so that dishonest people have an advantage.

SV reX

MegaDork

1/28/24 12:15 p.m.

In reply to brandonsmash :

I think you've been drinking the KoolAid.

Where is the actual discount for paying cash? If the selling price on a product is $100, adding 3% for credit makes it $103. If a vendor is going to offer a discount for cash, then they will first jack the price to $103, then sell it to me for $100 as a cash buyer. I haven't actually saved anything until the vendor is willing to DROP their price to $97.

But it's worse than that...

The $100 selling price already included a markup which was designed to cover the cost of credit purchases. It's called overhead. As a cash buyer I am already footing the bill for the cost of credit purchasing, and adding a fee on top of the sale for credit sales is actually doubling the credit charge.

Vendors never gave this away for free (and shouldn't). They have always been including the cost of credit sales in their markup, and adding an additional charge for credit purchases is actually increasing the markup.

Its evidence of a business being unable to properly manage their overhead costs. Vendors who give discounts for cash are not offering consumers a value, they are tax dodging. (And the consumer and the community still have to foot the bill for the taxes they have failed to pay)

SV reX

MegaDork

1/28/24 12:16 p.m.

In reply to Robbie (Forum Supporter) :

We agree.

In reply to SV reX :

Maybe I'm drinking the Kool aid because I own a small business and deal with this every day? I might, y'know, actually have a little firsthand insight into how these things actually work.

For years I listed prices as the cost and stipulated that there was a change for running a card. Finally I gave up and just raised my prices 3% and started sending out estimates saying that if you want to save 3% you can pay with cash or check if you ask. Otherwise, you can pay for your own airline rewards miles.

It sounds to me like you want to have your cake and eat it too. These things don't come for free, and it sounds as if you're misinformed about how transaction fees actually work on the merchant side (particularly with small businesses). But hey, if you don't want the option to save a few bucks and you would prefer to be unaware of the costs of purchasing goods or services, that's your prerogative.

I would also suggest that you're talking out your ass wrt tax dodging. The vast majority of my clients pay with checks. Those do not have processing fees associated and I report and pay taxes on every single penny. I'm also a bit insulted that you insinuate that I'm a tax cheat because I make clear the processing fees for cards and have passed them along to customers, as is my right.

I get it, you want the business to cover everything and not tell you what things cost. You don't want the option of paying less with cash or check. You think that any merchant who makes fees transparent doesn't know how to run a business, and anyone who passes along the fees they're charged (or offers discounts for paying with methods that don't incur them) is some sort of scurrilous tax-dodging ne'er-do-well.

Maybe if I were also strictly a consumer/end-user who didn't have skin in the game about the costs of doing business I would agree, but I suspect that we're not going to see eye-to-eye.

In reply to SV reX :

You're saving $3 because the new price is $103. The old price is not relevant at all. If the price is now $103 for everyone, but they discount it $3 because you're wearing blue shoes, you saved $3 for your footwear choice.

SV reX

MegaDork

1/29/24 9:35 a.m.

In reply to Steve_Jones :

That's a price hike, not a savings. It's a zero dollar savings.

SV reX

MegaDork

1/29/24 9:39 a.m.

In reply to brandonsmash :

I was not the first to mention tax cheating in this thread. Don't take things so personally.

I've owned my own business for 40 years. I have no idea why that is relevant.

You're making this far more difficult than it needs to be. Signs started showing up in businesses several years ago adding a charge for using credit cards. This was always included in overhead prior to that.

It's really pretty simple.

SV reX said:

In reply to Steve_Jones :

That's a price hike, not a savings. It's a zero dollar savings.

Prices get hiked all of the time. Everyone's new price is $103, if you buy it for $100 you saved $3 off of the new price. Can you buy a pack of cigarettes for $2 anymore? I remember when you could.