frenchyd said:

SVreX said:

Both.

I know lots of poorer people who never file a return at all.

They are foolish. Look up earned income tax credit.

And therein lies the central problem. "Poor" and " lack of financial acumen" often go hand in hand. Note that I did not say that everyone who is poor has bad financial acumen. Nor did I say that everyone who is poor is poor because they have bad financial acumen. Nor, in fact, did I say that everyone who has bad financial acumen is poor.

This is the internet. Gotta be clear.

What I said (and mean) is that OFTEN, people who are poor, lack basic financial acumen. And that this is a problem. If one makes 10,000 per year, and leaves $500 on the table at tax time, that's Five Percent of their yearly income. That's HUGE. I mean, relatively speaking. Telling them they are foolish for doing so ignores the real problem, though.

In reply to volvoclearinghouse :

I don’t have an easy answer for social justice. The economy is as complex as it is because it’s in the interest of the rich and powerful for it to be complex.

That way one group will blame the other group instead of focusing on the real problem.

Enyar

SuperDork

4/13/18 7:58 a.m.

Ian F said:

In reply to mtn :

My mother is similar (lacking the vacation home).

One of the potential hang-ups is most "rich" people don't have income in the same way working folks do, so the progressive tax structure doesn't apply. Much of their income is from capital gains through investments, which is taxed at 15%.

Really rich folks tend to have little real money and have it put in sheltered trusts and whatnot and a lot of what they "own" is actually owned by these trusts.

That said, they still tend to pay a lot in taxes - usually millions of dollars each year - but as a percentage of their "income" it can seem rather low.

LTCG rates for the top bracket is currently at 20% - not including the net investment income tax (3.8%). For this discussion let's exclude state income taxes as those results will vary

frenchyd said:

SVreX said:

lrrs said:

According to the WSJ......

https://www.wsj.com/amp/articles/top-20-of-americans-will-pay-87-of-income-tax-1523007001

According to that WSJ article, 77 million households in the bottom 2 tiers pay NEGATIVE taxes (they receive money, as opposed to paying it)

Its all in how you spin it.

Please read that statement carefully. That doesn’t say what you think it does. As Warren Buffet says he could pay zero tax if he choose to. ( and he explained the rule that would allow him to)

so let’s assume you make 800 million dollars this year. If you do your taxes correctly you can qualify for food stamps or welfare!! Technically you aren’t in the top percentage.

What that actually says is of those who paid taxes last year the top percent paid ———

Now that doesn’t count the perks and benefits. Things like private use of the Corporate jet. What would it cost you to take your family to a first class all expense paid vacation to France to watch the 24 hours of LeMans?

Well to the top 1-3%, nothing!! You’d simply conduct a business meeting for long enough to qualify and the whole thing is a business expense. Not the cheap $1800 an hour one. The $5-7,000 an hour one to make it non stop.

A suite for you plus one for each of your kids. Plus someone to watch them and keep them entertained ( and safe) 5 star meals. Etc etc etc. blah blah blah!!

I'd encourage people to ignore this comment as it's not correct

Enyar

SuperDork

4/13/18 8:02 a.m.

Like others said it really depends on your definition of fair share. If it's a % of income then you may be correct, but then I would argue that middle class incomes with multiple children are SEVERELY underpaying. If you're talking $ amounts I would say the rich are paying way more.

The new tax reform is changing a lot of this and we will see how it works out.

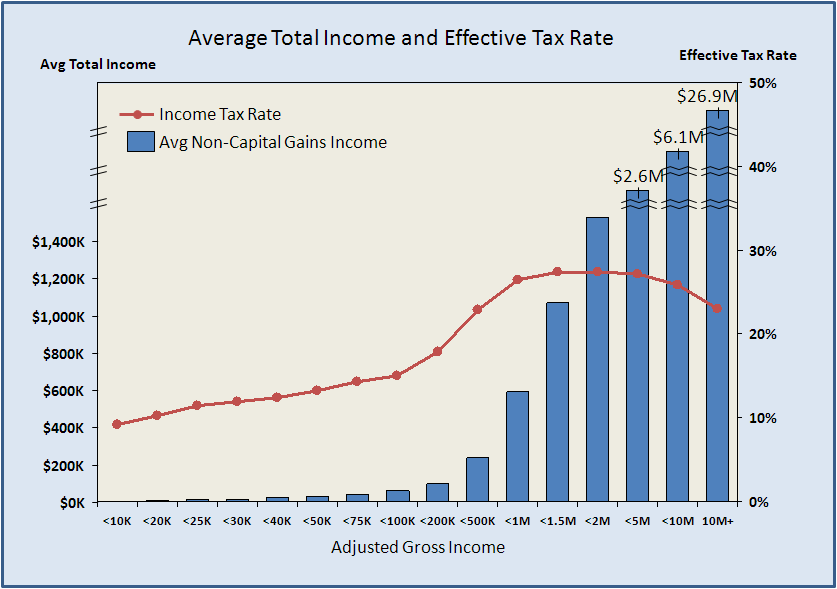

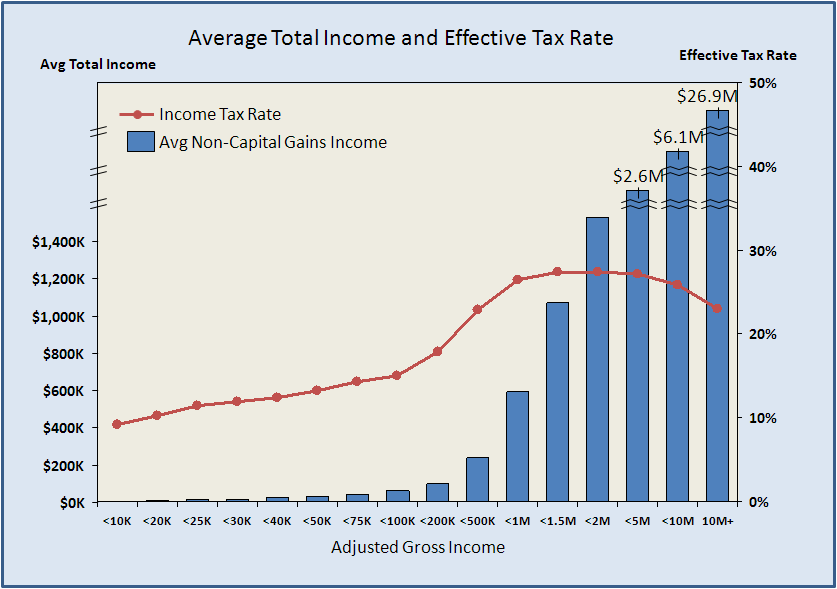

Lots of opinions, how about some data? Here's some from 2007:

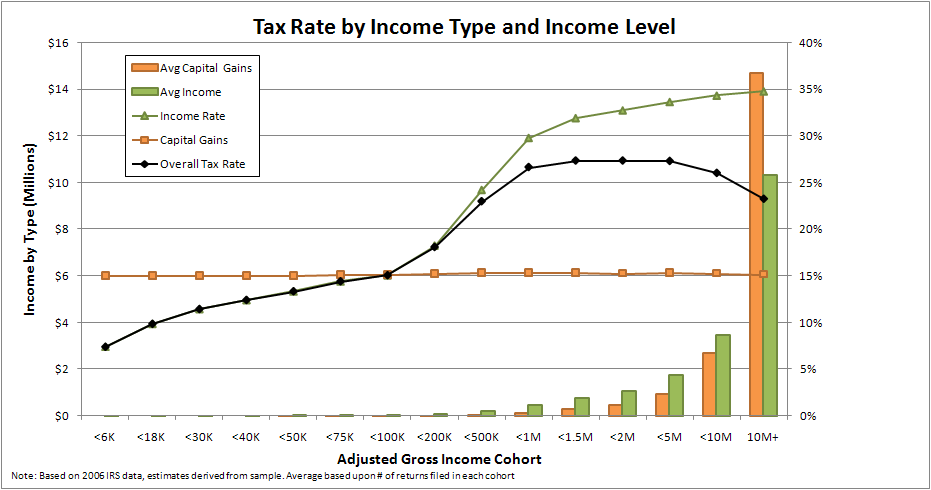

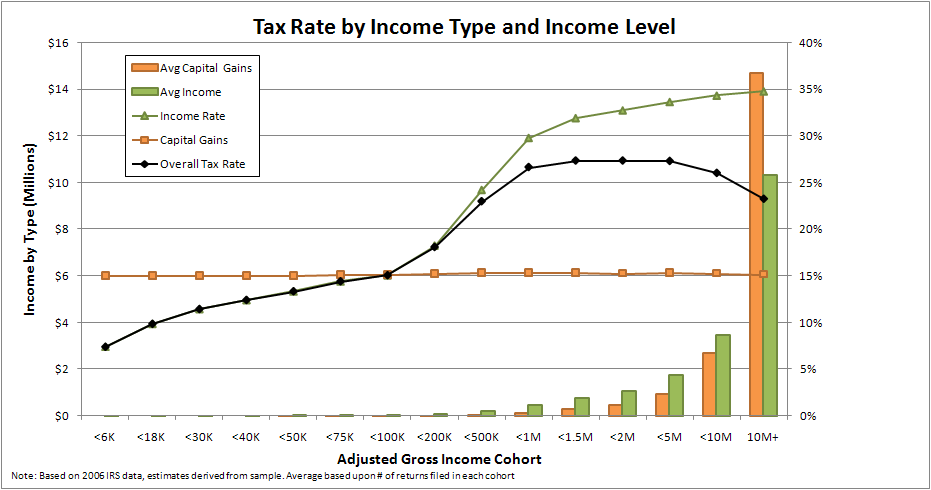

Mind you this is non-capital-gains income, and as you go over low-6-digits a year, capital gains tends to become a bigger and bigger part of your income. Unless you're a pro athlete or actor perhaps. This graph may help to clarify:

It wasn't always this way though:

But are the rich paying a fair share of taxes overall? The math says NOPE:

So do the rich pay a lot of taxes? In absolute dollars, yes. In percentages of their incomes, not really. Compared to the share of money they're making? LOL no!

Enyar

SuperDork

4/13/18 8:06 a.m.

loosecannon said:

Adam Carolla says he is rich and when he came to town for a comedy show, he showed his tax return on the big screen. It revealed that he made $1,000,000/year and paid just north of $400,000 in income taxes. That was before his podcast really took off so I'm sure he makes double that now. I'm in Canada and am middle to upper middle class in household income and we pay over 40% income tax and another 12% sales tax on everything, and I think we are way overtaxed considering out terrible healthcare and infrastructure problems.

Something is not adding up here. Worst case scenario I don't see him owing more than $350k but most likely he should owe less than this. What year are we talking?

SVreX

MegaDork

4/13/18 8:06 a.m.

frenchyd said:

SVreX said:

Both.

I know lots of poorer people who never file a return at all.

They are foolish. Look up earned income tax credit.

I didn't say they qualified for the EITC. I said I know people who do not file.

There is a difference between having money and earning money. If I hit the lotto tomorrow my income for this year would include millions. Once I paid taxes on that income I would have millions in my bank account.

If I quit my job after I won the lotto I would still have and be able to spend millions, but if I just left the money in my checking account I would have essentially zero income next year. I would be rich, but I would have no income and would pay no income tax because I wasn't earning any new money, and I had already paid taxes on what I have.

Unfortunately all the money sitting in my bank account doesn't do anything for the economy. We are all better off if I do something with it. But if I take a chance and invest in something I might actually lose money. I don't want to lose money. And if I make money on my investment you are going to want to tax what I make, which is me losing money again. I'm kinda risk averse, so I probably won't gamble my millions on something that might cost me money, and maybe not on something that might make me money either if I only get to keep 60% of what my investment is going to earn.

The compromise is all of us agreeing to tax my rewards for taking risk with the money I already paid taxes on at a lower rate. The perception that I get to keep more of my rewards if my investment gamble pays off influences me to risk losing it and reinvest it in the economy. The alternative isn't taxing at a higher rate, the alternative is me just leaving the money in my checking account.

Thing is, once I have millions in my bank account I can legally increase my wealth using it as collateral. Right now if I buy a house I don't count the mortgage as income and over the course of the loan I get to right off the interest because we have all agreed that's a wonderful way to stimulate the economy and promote the social benefits of home ownership. The year after I hit the lotto all those things still apply, except that any bank is going to loan me whatever I want based on the millions in my bank account as collateral. So I buy a three million dollar house with a new loan instead of the millions in my bank account. The interest on that loan would be a write off if I had any income. So a little math later and I can figure out how much income has a tax obligation just slightly higher than the tax write off for the mortgage. Now I invest enough of my millions to earn me an income of about that much. Now I am growing my wealth and paying essentially no income tax.

But the bank is getting paid that interest, the realtor got their commission, the craftsmen working on my house are earning money, and I am paying property taxes and sales taxes on anything I buy for the house. All the social benefits of home ownership are in effect, I am rich and getting richer, but I pay no income tax.

mtn

MegaDork

4/13/18 8:16 a.m.

I initially posted in this while slightly distracted.

Question is way too ambiguous. Are we talking wealthy in actual, physical assets (cash+real estate less liabilities) or in earned income or...?

Someone earlier in the tread said 6 digits is probably the line between middle and upper class in there's area. Where I am, it's probably $200k. I've also been to places where it was $75k. But that income doesn't make you [monetarily] rich. The richest people Ive known have had zero income other than capital gains.

Enyar

SuperDork

4/13/18 8:26 a.m.

GameboyRMH said:

But are the rich paying a fair share of taxes overall? The math says NOPE:

So do the rich pay a lot of taxes? In absolute dollars, yes. In percentages of their incomes, not really. Compared to the share of money they're making? LOL no!

This info graphic raised a couple red flags with me so I did some research. It's an opinion piece from this blog:

http://blogs.reuters.com/david-cay-johnston/2011/10/25/beyond-the-1-percent/

He either needs to be more clear as to what he's including in taxes or income taxes. My guess is he's including medicare and social security. If were strictly talking federal income taxes there is no way this is right. Maybe I am misunderstanding.

Duke

MegaDork

4/13/18 8:36 a.m.

loosecannon said:

I'm in Canada and am middle to upper middle class in household income and we pay over 40% income tax and another 12% sales tax on everything, and I think we are way overtaxed considering out terrible healthcare and infrastructure problems.

HOW DARE YOU SAY THAT! CANADA IS A POPULIST PARADISE THERE IS NO OTHER REALITY.

My wife and I are somwhere between the 80th-85th percentile for income (which isn't really all that much). Our effective tax rate is somehwere around 20%-25%. I'm finalizing my return this weekend and I will correct that number once I know the results.

Grizz

UberDork

4/13/18 8:45 a.m.

volvoclearinghouse said:

Interesting anecdote:

This guy owes the IRS One Billion Dollars.

If you look at the IRS forms, you'll see that the IRS cannot accept checks of $100M or greater. So this guy has to write 11 check to Uncle Sam to cover his 2017 tax bill.

Do you think he postdates his checks of 99M?

I don't talk about this often but my dad easily qualifies as "rich". He is mostly retired but still partners in an engineering tech company...and his taxes are staggering. He is still working on taxes from 2016 and this is not uncommon. Just the accountant bill is probably more than I make. It is interesting to hear everyone's opinion on taxes, but the reality is that most wealthy people pay huge sums to the government. You can cheat and pay less, but even adding in capital gain taxes his effective rate is far higher than mine. And that doesn't include factoring sales and property taxes. He started with nothing and earned everything he had...how much of "his" money is fair for him to keep when the gornment already takes close to half?

A quick word on gains, you have already been taxed on the earned portion, the lower profit tax is to encourage investing. Without it the economy would suffer. Not to mention you and I also benefit as does every retirement account.

It's a touch subject. Sure there are those that abuse it, but for the most part those with money already pay large percentages.

Enyar said:

This info graphic raised a couple red flags with me so I did some research. It's an opinion piece from this blog:

http://blogs.reuters.com/david-cay-johnston/2011/10/25/beyond-the-1-percent/

He either needs to be more clear as to what he's including in taxes or income taxes. My guess is he's including medicare and social security. If were strictly talking federal income taxes there is no way this is right. Maybe I am misunderstanding.

Source data is here:

https://www.irs.gov/statistics/soi-tax-stats-individual-statistical-tables-by-size-of-adjusted-gross-income

Specifically these two Excel files:

https://www.irs.gov/pub/irs-soi/09in14ar.xls

https://www.irs.gov/pub/irs-soi/09in35tr.xls

The SS thing confounds the issue. Lots of people include that on the "total taxes I pay" list, but you stop paying it at $128k in earned income for the year. This reduces your overall "rate" depending on how you calculate it. Also if if you're spending 50% of everything you take home on things that collect sales tax and your sales tax rate is 6%, then add more to that total tax rate. Lots of ways to add up to columns.

Through my social circle with cars I get to hang out with people who make anywhere between about $40k and well north of $500k a year. Everyone says they're doing ok, they could use 10% more, and they pay too much in taxes.

SVreX

MegaDork

4/13/18 8:56 a.m.

oldopelguy said:

There is a difference between having money and earning money. If I hit the lotto tomorrow my income for this year would include millions. Once I paid taxes on that income I would have millions in my bank account.

If I quit my job after I won the lotto I would still have and be able to spend millions, but if I just left the money in my checking account I would have essentially zero income next year. I would be rich, but I would have no income and would pay no income tax because I wasn't earning any new money, and I had already paid taxes on what I have.

Unfortunately all the money sitting in my bank account doesn't do anything for the economy. We are all better off if I do something with it. But if I take a chance and invest in something I might actually lose money. I don't want to lose money. And if I make money on my investment you are going to want to tax what I make, which is me losing money again. I'm kinda risk averse, so I probably won't gamble my millions on something that might cost me money, and maybe not on something that might make me money either if I only get to keep 60% of what my investment is going to earn.

The compromise is all of us agreeing to tax my rewards for taking risk with the money I already paid taxes on at a lower rate. The perception that I get to keep more of my rewards if my investment gamble pays off influences me to risk losing it and reinvest it in the economy. The alternative isn't taxing at a higher rate, the alternative is me just leaving the money in my checking account.

Thing is, once I have millions in my bank account I can legally increase my wealth using it as collateral. Right now if I buy a house I don't count the mortgage as income and over the course of the loan I get to right off the interest because we have all agreed that's a wonderful way to stimulate the economy and promote the social benefits of home ownership. The year after I hit the lotto all those things still apply, except that any bank is going to loan me whatever I want based on the millions in my bank account as collateral. So I buy a three million dollar house with a new loan instead of the millions in my bank account. The interest on that loan would be a write off if I had any income. So a little math later and I can figure out how much income has a tax obligation just slightly higher than the tax write off for the mortgage. Now I invest enough of my millions to earn me an income of about that much. Now I am growing my wealth and paying essentially no income tax.

But the bank is getting paid that interest, the realtor got their commission, the craftsmen working on my house are earning money, and I am paying property taxes and sales taxes on anything I buy for the house. All the social benefits of home ownership are in effect, I am rich and getting richer, but I pay no income tax.

That's a really good summary

STM317

SuperDork

4/13/18 8:58 a.m.

mazdeuce - Seth said:

Through my social circle with cars I get to hang out with people who make anywhere between about $40k and well north of $500k a year. Everyone says they're doing ok, they could use 10% more, and they pay too much in taxes.

I was going to say something similar. I bet if you asked each of them, the majority would consider themselves to be "middle class" too. The way that we perceive ourselves is funny. Very few objectively wealthy people consider themselves to be part of the wealthy elite because there's always somebody with more.

racerdave600 said:

It's a touch subject. Sure there are those that abuse it, but for the most part those with money already pay large percentages.

Check the graphs I posted above. The people making tens or hundreds of times more than us mere mortals are paying less than 3x the percentages we are on income alone, which makes up from 3/4 to less than half of their total income vs. capital gains. That's not a large percentage of such astronomical amounts of money given to just one human to spend. Many of these annual incomes are more than a normal person could earn in a lifetime of hard and clever work.

I'll just be over here wondering why we are taxed on income in the first place...

I didn't read nor am I'm going to get into the debate, however, this I will say.

www.fairtax.org

That's the direction we should take the tax code.

Nick Comstock said:

I'll just be over here wondering why we are taxed on income in the first place...

Same here. In the lotto example I detailed above if my principle tax burden were sales taxes I would be paying no matter how much I had in the bank or earned. That would reward saving and punish spending, though , which while certainly responsible and arguably the most socially responsible option doesn't promote a wildly growing economy.

But sales tax rates are easier to adjust and arguably more transparent and I could probably get behind that. It would make incentivising certain products easier for sure, which could be socially interesting.

z31maniac said:

I didn't read nor am I'm going to get into the debate, however, this I will say.

www.fairtax.org

That's the direction we should take the tax code.

Strongly disagree, sales taxes are effectively regressive since the lower your income is, the greater amount (percentage of income) you need to spend on basic necessities (which you have to pay tax on). Sales taxes are also more difficult to administer than income taxes. I generally think sales taxes should be minimized or eliminated and income taxes should have sharply progressive brackets.

Also while I was looking for data I ran across this excellent article pointing out why a flat tax is a terrible idea, unless you're rich:

https://floodingupeconomics.wordpress.com/2010/12/22/u-s-income-tax-who-paid-what-in-2009-and-the-flat-tax-scam/

SVreX

MegaDork

4/13/18 9:49 a.m.

In reply to GameboyRMH :

That's not true.

There is nothing about a flat tax that would necessitate charging tax for necessities. They could easily be exempted, or discounted for people under certain income brackets.

That is a common (ill-founded) argument.

The benefits far outweigh the negatives. Unless you are counting the political benefits of an overly complicated tax structure. If that's the goal, well then yeah, a flat tax wouldn't work too well.

GameboyRMH said:

z31maniac said:

I didn't read nor am I'm going to get into the debate, however, this I will say.

www.fairtax.org

That's the direction we should take the tax code.

Strongly disagree, sales taxes are effectively regressive since the lower your income is, the greater amount you need to spend on basic necessities (which you have to pay tax on). Sales taxes are also more difficult to administer than income taxes. I generally think sales taxes should be minimized or eliminated and income taxes should have sharply progressive brackets.

Also while I was looking for data I ran across this excellent article pointing out why a flat tax is a terrible idea, unless you're rich:

https://floodingupeconomics.wordpress.com/2010/12/22/u-s-income-tax-who-paid-what-in-2009-and-the-flat-tax-scam/

Tax that’s progressive assumes it’s tax equally. 77,000 pages of the tax code that apply only to the rich makes nonsense out of the progressive argument.

Only 30-40 pages of the tax code apply to 90% of the population.

So let’s ensure that we at least get something.

But and this is the big but.... no exception!!!!! Tax companies buying material. Tax investors buying stock, tax churches and schools and government.