Yeah its a bit out of control in my and nearby zip codes. Like 1100$-1400$ a sqf average for a nice home that was remodeled in the 90s. If you have a water view or are on a hi street route double that price.

Yeah its a bit out of control in my and nearby zip codes. Like 1100$-1400$ a sqf average for a nice home that was remodeled in the 90s. If you have a water view or are on a hi street route double that price.

https://www.realtor.ca/real-estate/26793501/800-myers-road-unit-101-cambridge

This is an example of the craziness of market where I am. There are four units per building. The bigger 2 floor units are $649,000.

I grew up and went to college around 15010, I have lived near Toyman! Since 2006. Here it is completely supply and demand. So many people moving here, no one wants to live in the cheap infill areas (with high crime rates). I am surprised that western PA has seen the same increase with that population declining. My siblings have owned in NYC and SF, also they have lived in Boston and Hawaii. Nothing compares to those prices.

The average and median home value and price around us are a little over $1M. The cheapest nothing special single family starter home currently for sale is $775k. We've long since lost the ability to buy into this area if we hadn't done so when we did, and have been exceedingly fortunate in this regard. How other people are managing to do it, I have no idea.

Case Shiller (nationwide) shows houses have appreciated more in the last 4 years than they did in any of the previous 3 decades. Well, they climbed quite a bit more from 2000-2007, but then something happened and by the end of 2009 appreciation was down to "only" 47.3% for the decade.

In my little neighborhood, prices range from the mid-200's to a bit over 500K. My house is one of the least expensive with a Zillow-estimate of 247K - which is up about 40K since the last time I looked. My neighbors to either side are over 300K. The one house currently for sale a block over is asking 400K.

However, when adjusted for inflation, 246K is only about 46K more than the 89K we paid for the house in 1992, which is about 200K today.

Here in Vancouver, my building for instance, bachelor suites (no bedroom) are priced around $650k CAD or roughly $477k USD, one bedrooms are around $730K CAD, and two bedroom places start around $1m CAD.

I dont think you could find a stand alone house for less than $1m unless you move at least an hour outside of the city. I'm lucky I can use my parents place to work on things, if that house ever sells, then no more car stuff for me.

RoddyMac17 said:Here in Vancouver, my building for instance, bachelor suites (no bedroom) are priced around $650k CAD or roughly $477k USD, one bedrooms are around $730K CAD, and two bedroom places start around $1m CAD.

I dont think you could find a stand alone house for less than $1m unless you move at least an hour outside of the city. I'm lucky I can use my parents place to work on things, if that house ever sells, then no more car stuff for me.

I was on a flight with a Vancouver developer. He is a very happy man.

We cashed out of the suburbs of Vancouver two years ago.

It's downright nutty there.

We bought our house there 13 years ago and paid $475,000 for a 2100 sq ft house on a 7000 sq ft lot. I remember thinking that I paid way too much and if it ever doubled we would get the hell out.

11 years later we did just that. Sold, paid out our mortgage and bought 44 acres in the middle of nowhere, free and clear.

I don't know how anyone is supposed to get into the property market in Vancouver these days.

A shack from the 70s that you need to drive a Cat through costs a million bucks these days.

We bought our place for $170k in 2016(and that was more than every property I'd previously purchased combined). I just got a letter today from the underwriting company that we need to up our coverage to $375k. Our agent ran the numbers & confirmed it.

Granted, that's replacement cost, but the neighbors have their(much nicer) home listed for $799k currently. That seems crazy when the 2 homes across the street from us sold for ~$70k in 2017 and ~$100k in 2018.

There's also a home down the street that's half the size of ours, with no garage/shed/gazebo & on a small lot that's listed for $170k. We could never afford to move here now, so I'm damn glad we did when we could!

SV reX said:The average is $161,941

I'm on my mother berkeleying way! I just need some acres and a workshop.

Where I live I need to make about $320k a year to be able to afford what I want. And what I want isn't much.

We built ours for $65k in 1982. It's now worth approx $2.2m. Which really doesn't matter because we're not leaving. Two story but master bedroom is down so we can age in place.

But the best part is our property taxes are only about $4500/year. Thank you Proposition 13.

I don't have the data for the area, but we bought at $345k in 2016, stretched out budget to the extreme to do it.

Today, the house would sell for $450k to $500k and be torn down immediately. I'd love to sell, except I'd have to move somewhere and can't afford anywhere else without moving far enough away that it isn't worth it for our current situation, especially when you consider our 2.3% mortgage.

I saw someone mention the Boomers dying off adding to the housing stock... how do the millennials who haven't been able to afford a home and the Gen Z kids coming into adulthood impact that?

In reply to mtn :

I was assuming that Boomers dying was going to open up enough inventory to allow Millenials / GZs to buy in at more reasonable prices.

In reply to Duke :

They are supposed to dump almost 10 million homes on the market in the next 10 years.

In reply to Duke :

I'm not sure the "dying off" part is happening as quickly as the number of Millennials hoping to enter the market. Many are also aging in place and not selling. My mother, for example, has no plans to sell her house anytime in the near future and market-wise, her house would be a good starter-home for the area.

Then you have Gen Xers who are sitting put and not moving or upgrading.

While there seems to be a lot of media attention given to Baby Boomer and GenX empty-nesters down-sizing in various ways, I'm not sure that represents a large enough portion of the market to improve the housing supply issue.

It would have been interesting to see what the property taxes are on these places as well.

My oldest son and his wife are doing well, but will inherit two farms at some point, and have some decisions to make.

We realized on our last vacation that, with our savings and what has happened with property values, we could sell our place, buy a very nice one in Aruba, and live like kings the rest of our lives. Hmm.

Boomers didn't have to compete for inventory with housing equity portfolios, which <soapbox>hoover wealth from the middle class while forcing prospective first-time buyers toward perpetual renting</soapbox>.

Young Millennials and GenZ will just have to pull themselves up by their bootstraps go in debt and buy a home.

In reply to DancesWithCurves :

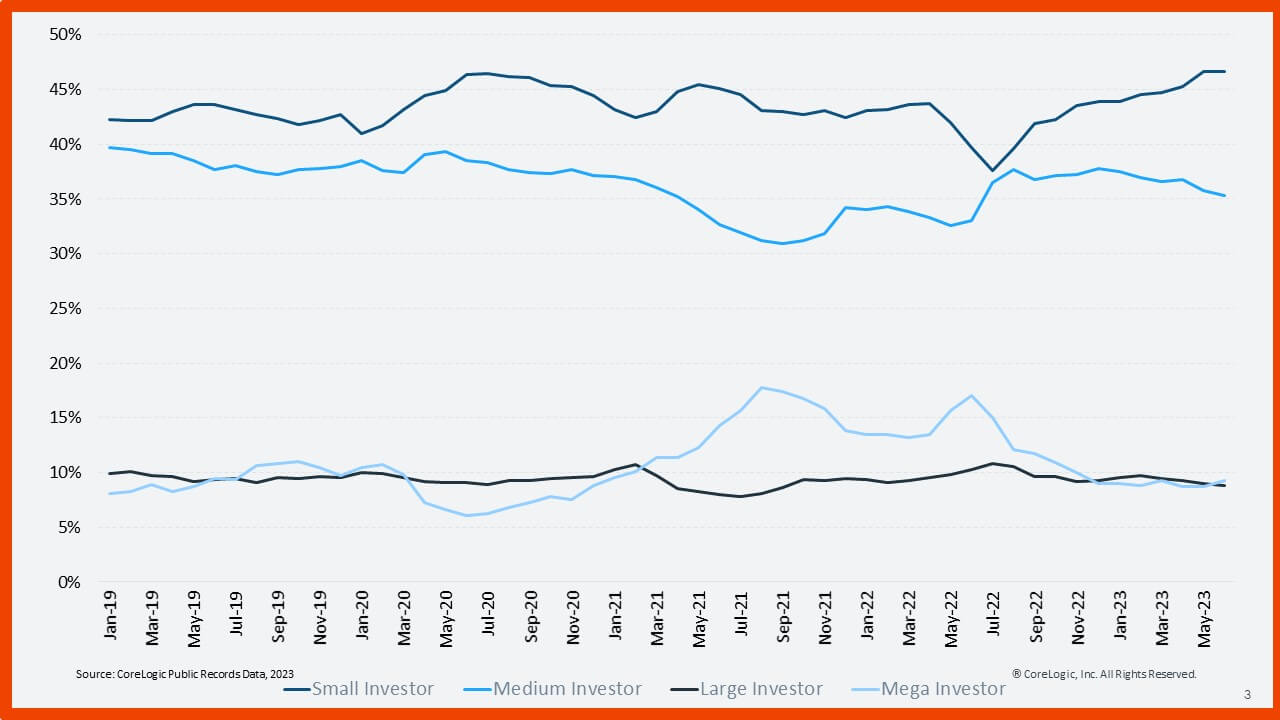

Corporate investors only own about 4% of the available market. They aren't what is driving prices. They also buy fewer homes than the rest of the investors.

If investors are driving prices, it's the small investors. The people with 3-9 homes. They represent almost 50% of the investor purchases.

In reply to Toyman! :

You may be right but the thing about a system that's "full," meeting supply and demand in more or less equilibrium, is that any increase in demand can result in a massive spike in prices. It doesn't take 50%. It can be 1%. Just enough to tip the scales one way and the system is suddenly out of balance.

You'll need to log in to post.