CrustyRedXpress said:

In reply to Flynlow (FS) :

I just typed out a response, but it got way too long. If you're interested in this stuff, i.e. emergency programs that were created in 2008-2009, then you should read Geitner's Stress Test. Essentially, most of what they (Treasury, Fed, etc) did during '08 was provide liquidity to a bunch of different organizations by any means possible to prevent bank runs and the collapse of the financial system. I think in this situation you want the Fed to have junk MBS on it's balance sheet because if Fanny/Freddy collapse and the overnight market locks up we're all deeply, deeply boned while the Fed can absorb the losses by just sitting on them.

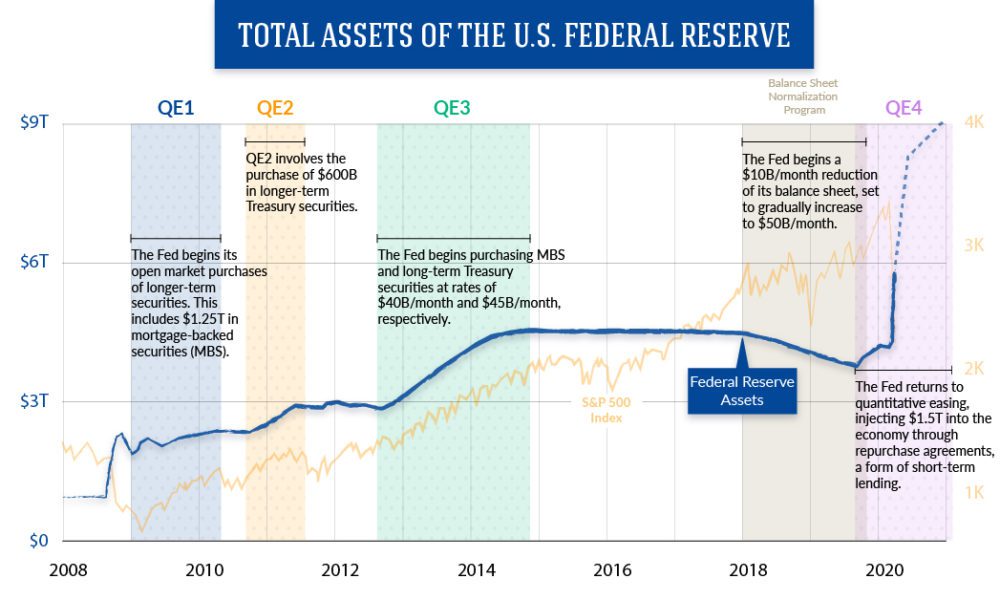

As far as reform the system, read up on Dodd/Frank and make your own conclusion. At the very least the Fed has a lot more tools at it's disposal than last go-round. When Covid hit in 2020 they used them to backstop the market and avoid the recession...which is the outcome that we'd hope for.

https://finance.yahoo.com/news/fed-seizing-control-entire-u-144633849.html

Thanks for the reading suggestion, I will check it out.

I can understand the logic behind a temporary, short term relief program to avoid runs on the banks and people panicking because they can't get cash. I don't agree, but I understand it as a valid suggestion to put forth. Alternatively, 1.) we already have a program in place to prevent runs on the bank, in that all accounts under $250K for consumers are insured through FDIC, and most runs on the banks are normal consumers trying to get cash out of their checking accounts, not business calling accounts due at Wall Street, and 2.) that excuse has been put forward to avoid a "liquidity crisis", but it has been going on for 10+ years. That is not a short term fix, but evidence of a systemic problem. For the Covid 2020 example, that was also the original timing of the Fed pulling back bond purchases and raising rates. So was the March recession a Covid drop, or the market panicking when the free money spigot got turned off for the first time in a decade? I'm genuinely curious to see as it starts to be implemented again this year.

In my opinion, far more of the commercial banks should have been left to twist in the wind post-2007. If they can stabilize their books and pay their debts, great. If not, break them up, let them go bankrupt, whatever. As they are so fond of telling us, "All investments carry some degree of risk. Stocks, bonds, mutual funds and exchange-traded funds can lose value, even all their value, if market conditions sour." They risked big on CDOs, and lost. Time to pay the piper. By subsidizing their losses, we have enabled them to increase their leverage and not learn from their mistakes. Letting them fail would have rendered Dodd-Frank unnecessary, the painful experience would have self taught them some risk management and self control. Again, let the free market work. It would not have been the end of the world. Even worst case, if ALL the large commercial/wallstreet banks failed, regional and local banks would have continued to lend (in lesser amounts and under higher conditions/restrictions, certainly) and would have grown and flourished. The Fed can lend money to those banks under pre-2007 programs without issue for liquidity.

But again, this is just one worldview of many. I don't think the Feds job is to avoid recessions, I think they are a natural economic condition that prunes the deadwood and punishes overly leveraged/risk-taking investors, leaving room for more prudent investors and businesses to flourish and take their place.